코바야카와 ë ˆì´ì½”(Korean) translates to something like “effective ways to save money” in Indonesian. This article will delve into practical strategies for improving your personal finances and achieving your savings goals. Whether you’re aiming for a down payment on a house, funding your dream vacation, or simply building a financial safety net, understanding and implementing effective saving techniques is crucial.

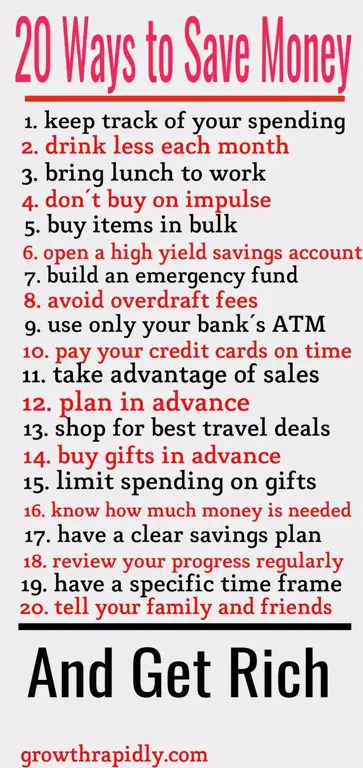

Saving money isn’t just about restricting spending; it’s about making conscious financial decisions that align with your long-term objectives. It requires planning, discipline, and a willingness to adapt your habits. This guide will provide a comprehensive approach, exploring various methods and offering actionable steps you can take today to start saving more effectively.

Memulai dengan Anggaran yang Efektif

The foundation of successful saving lies in creating and sticking to a realistic budget. A budget allows you to track your income and expenses, identifying areas where you can cut back and redirect funds towards savings. There are numerous budgeting methods available, from simple spreadsheets to sophisticated budgeting apps. Experiment to find what works best for you.

Metode 50/30/20

The 50/30/20 budgeting rule is a popular approach. It suggests allocating 50% of your after-tax income to needs (housing, food, transportation), 30% to wants (entertainment, dining out), and 20% to savings and debt repayment. This framework provides a clear structure for managing your finances.

Aplikasi dan Alat Penganggaran

Numerous budgeting apps and software programs can streamline the process. These tools often automate tracking, provide insightful visualizations of your spending, and offer features like goal setting and automated savings transfers. Explore different options to find one that suits your needs and technical skills.

Menemukan dan Mengurangi Pengeluaran yang Tidak Perlu

Once you have a clear picture of your spending habits, identify areas where you can reduce unnecessary expenses. This might involve scrutinizing your subscriptions, cutting back on eating out, finding cheaper alternatives for everyday items, or negotiating lower bills for services.

Tinjau Langganan Anda

Many people unknowingly pay for subscriptions they no longer use or need. Regularly review your subscriptions (streaming services, gym memberships, software) and cancel any that are unnecessary. This can free up a significant amount of money over time.

Membeli dengan Bijak

Before making a purchase, ask yourself if it’s a need or a want. Compare prices, look for discounts, and avoid impulsive buying. Consider buying used items or opting for more affordable alternatives to save money.

Meningkatkan Pendapatan Anda

While reducing expenses is crucial, increasing your income can significantly boost your savings potential. Explore opportunities for additional income streams, such as a part-time job, freelance work, or selling unused items.

Mencari Pekerjaan Tambahan

A part-time job can supplement your income and accelerate your savings goals. Consider your skills and interests when searching for suitable opportunities.

Freelancing atau Gigs

Freelancing allows you to offer your skills on a project basis, providing flexibility and the potential to earn extra income. Numerous online platforms connect freelancers with clients.

Menjual Barang yang Tidak Terpakai

Decluttering your home and selling unused items can generate extra cash. Online marketplaces and consignment shops offer convenient platforms for selling.

Menentukan Tujuan Keuangan dan Membuat Rencana

Setting clear financial goals and creating a plan to achieve them is vital for maintaining motivation and tracking your progress. This could involve setting short-term, medium-term, and long-term savings goals. Regularly review your progress and adjust your plan as needed.

Membuat Tujuan yang Spesifik, Terukur, Dapat Dicapai, Relevan, dan Terbatas Waktu (SMART)

Using the SMART goal framework ensures your goals are realistic and achievable. For example, instead of a vague goal like “save more money,” aim for a specific target, like “save Rp 10,000,000 in six months”.

Meninjau dan Menyesuaikan Rencana Anda

Life circumstances can change, so it’s crucial to regularly review and adjust your financial plan to reflect your current situation. This ensures your plan remains relevant and effective in helping you achieve your objectives.

By implementing these strategies, you can effectively save money and achieve your financial goals. Remember that consistency and discipline are key. Start small, build momentum, and celebrate your progress along the way. Your future self will thank you for it.